Introducing CYCLOPS: A Comprehensive Approach to Natural Capital Monitoring

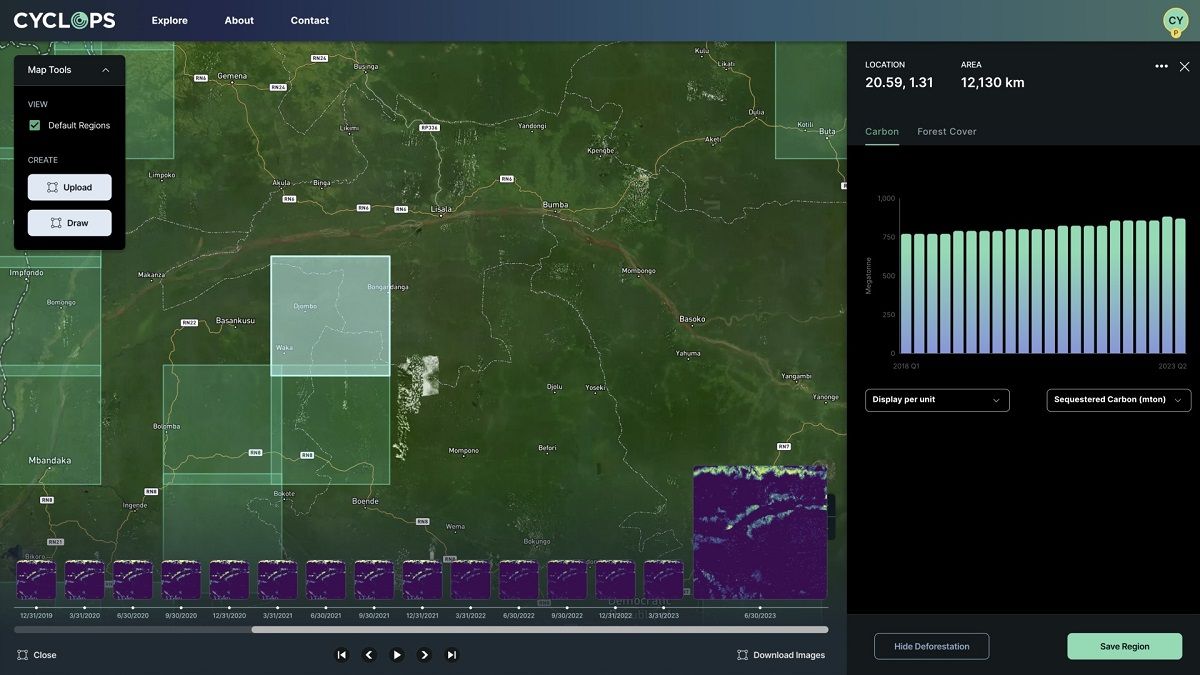

Environmental monitoring, particularly in the domain of natural capital and the voluntary carbon market, demands precision, transparency, and accountability. Today, we are proud to introduce CYCLOPS (Calculating Yearly Carbon Levels Over Perennials and Savannah), an advanced data model and open digital measurement, reporting, and verification (dMRV) platform that transforms how these vital sectors are monitored and managed.

Understanding the Need for CYCLOPS

Natural Capital and the Voluntary Carbon Market Explained

Natural capital is an umbrella term that represents the sum total of the Earth’s ecosystems, biodiversity, and essential resources. These elements are interwoven into the fabric of our planet and are indispensable for the survival and prosperity of all life forms. From the dense forests that act as the lungs of our planet to the rich biodiversity that ensures ecological balance and resilience, natural capital forms the bedrock of our planetary health and socio-economic development.

But merely recognizing the importance of natural capital isn't enough. To genuinely safeguard and nurture these assets, we must effectively manage them. This is where efficient monitoring and verification come into play. Such processes, when executed diligently, act as the gatekeepers of authenticity. They provide a transparent lens through which stakeholders can evaluate the impact and effectiveness of carbon credit projects and various conservation initiatives. When a project claims to offset a certain amount of carbon or protect a specific tract of forest, monitoring and verification provide the empirical evidence to back these claims, bolstering their credibility.

However, the traditional methods of ensuring this transparency and credibility have their drawbacks. Many of these methods are labor-intensive, relying heavily on on-ground manual assessments. Not only are these processes time-consuming, but they also introduce a range of potential human errors, from data collection inconsistencies to subjective biases. Moreover, they often lack the ability to provide a holistic view of a large area or ecosystem, leading to potential gaps in understanding and reporting.

Additionally, as our world changes rapidly – with forests being cleared, species facing extinction, and climates shifting – the static and periodic nature of manual assessments may not capture these changes in real-time or with the granularity required. Such limitations underscore the pressing need for more dynamic, accurate, and encompassing methodologies in natural capital monitoring.

Delving Deeper: The Intricacies and Challenges of Monitoring Natural Capital and the Voluntary Carbon Market

Understanding Natural Capital Monitoring

Effective monitoring of this capital is pivotal, not just for an academic understanding but for practical reasons like resource management, conservation efforts, and policy formulation. It acts as our window to gauge the health and vitality of ecosystems, from expansive forests and wetlands to coral reefs.

However, current monitoring methods come with an array of challenges:

- Time Constraints: Traditional methods, often relying on manual field surveys, are time-intensive. This delays the availability of critical data, which can be detrimental, especially when timely interventions are needed.

- Cost Implications: Extensive on-ground surveys and manual data collection can be prohibitively expensive, particularly for vast or hard-to-reach areas.

- Human Error: Manual methodologies can introduce inconsistencies, potential biases, or inaccuracies. Two teams assessing the same area might come back with slightly different data points due to subjective interpretations.

Challenges in the Voluntary Carbon Market

The voluntary carbon market operates as an arena where entities can compensate for their emissions by investing in projects aimed at carbon reduction or sequestration. While its intentions are commendable, its operations are not without obstacles:

- Verification Hurdles: Ensuring that a project genuinely offsets the amount of carbon it claims to can be daunting. Without rigorous verification mechanisms, there's a risk of projects over-claiming their impact.

- Baseline Establishment: Setting an accurate baseline, which acts as a reference point to measure a project's impact against, is crucial. An erroneous baseline can lead to misleading results about the amount of carbon reduced or sequestered.

- Long-term Monitoring: Many projects in the carbon market pledge long-term benefits. Ensuring these projects deliver on their promises over extended periods is a complex task, requiring consistent and reliable monitoring mechanisms. Frequent monitoring is essential to safeguard the integrity of climate finance projects, but is often not feasible using manual methods.

The Need for Evolution

In the face of these challenges, there emerges a clear necessity for evolution in the monitoring paradigms of both natural capital and the voluntary carbon market. Transparency, which bolsters trust, and accountability, which ensures reliability, stand out as two pillars that these sectors need to strengthen.

Embracing data-driven methodologies could be the linchpin in this transformation. Such approaches, harnessing the power of modern technology, have the potential to offer real-time insights, minimize human error, and provide a more holistic view of ecosystems or carbon projects.

CYCLOPS: Leading the Change

The CYCLOPS Open Platform - Building Bridges for Stakeholders

At its core, CYCLOPS is designed as an open platform, meticulously crafted to act as an interface between various stakeholders in the natural capital and carbon credit markets. This openness is not merely a feature but a philosophy, recognizing that for any conservation or climate finance initiative to be effective, multiple parties - from project developers to investors and from researchers to policymakers - need to collaborate seamlessly.

Through CYCLOPS, project developers gain access to a transparent ecosystem where they can showcase their initiatives, backed by tangible data and real-time monitoring. Investors, on the other hand, can leverage the platform to assess project risk, delve deep into ongoing developments, and make data-driven decisions about where their funds would have the most substantial, sustainable impact.

Technology at the Heart of CYCLOPS

While the idea of an open platform is commendable, it's the technology that lives under the surface of the CYCLOPS platform that truly sets it apart.

- Remote Sensing: CYCLOPS leverages the power of advanced remote sensing technology to capture real-time data from vast stretches of forests, spanning varied terrains and regions. This capability not only accelerates data collection but also ensures that no corner, however remote, remains unmonitored.

- Geospatial Intelligence: By layering remote sensing data with geospatial insights, the platform can offer stakeholders a detailed spatial understanding of the terrain. This is invaluable in understanding how specific environmental factors or external interventions might be affecting the health and growth of forests.

- Generative AI Techniques: Perhaps the most cutting-edge aspect of the CYCLOPS tech stack is its use of generative AI models. These models are trained on vast datasets to understand how forests typically grow, what a thriving forest ecosystem looks like, and the various factors influencing it. Over time, as the models are fed more data, they evolve, refining their understanding and enhancing their predictive capabilities. In practical terms, this means CYCLOPS can identify abnormalities even before they become glaring issues. From spotting early signs of deforestation to detecting subtle changes in biomass and carbon stock, the platform's AI capabilities are always on the lookout, ensuring forests remain protected and projects stay on track. CYCLOPS is a prime example of how artificial intelligence can be used as a key tool in the fight against climate change, helping us to better understand our planet and its complex ecosystems.

Why CYCLOPS Matters

In an era where the importance of conservation is universally acknowledged but effectively monitoring it remains a challenge, CYCLOPS emerges as a beacon of hope. By ensuring that every project, every tree, and every initiative is transparently tracked and evaluated, CYCLOPS paves the way for a more sustainable, green future.

Interested in learning more about CYCLOPS and its offerings?

We are proud to announce that CYCLOPS is live and the platform is open for anyone to start using TODAY!

You can watch the webinar and platform demo to learn more about CYCLOPS.

To schedule a private demo with our team, please complete this brief interest form or click the link below! 👇

Watch the Announcement Presentation during ReFi NYC 2023

Sid Jha, co-founder of dClimate, first revealed CYCLOPS to the attendees at ReFi NYC. You can watch his talk below for more information!